The Ultimate Guide to Financial Modeling for Startups: Building a Financially Sustainable Business

Launching a startup is exciting, but managing its finances can be daunting. That’s where a financial model comes in—it’s not just an Excel sheet full of numbers, it’s your startup’s financial roadmap. It helps you understand where your money is coming from, where it’s going, and how you can avoid common pitfalls like running out of cash.

Whether you’re seeking funding or just trying to survive the early stages of your business, a solid startup financial model is essential. In this guide, we’ll walk you through everything you need to know about financial modeling for startups—from why it’s crucial, to how you can build one that works for your specific needs.

Why Should Startups Care About Financial Modeling?

If you’re serious about building a financially sustainable business, you need to understand the importance of financial modeling. Let’s break it down:

- Financial Viability: You’re in this for the long haul, right? A financial model helps you figure out if your business is going to be financially viable. By running different scenarios (best, worst, and middle-of-the-road cases), you’ll know whether you can keep the lights on and pay your team.

- Planning for the Future: The beauty of a financial model is that it lets you project future financial performance. Whether you’re launching a new product, entering a new market, or scaling operations, your model helps you estimate what these moves will mean for your cash flow and overall business health.

- Attracting Investors: Investors don’t just care about your product—they care about your numbers. A well-built startup financial model shows them you’ve thought about how to spend their money, how to grow it, and when they’ll see a return. It’s essentially a trust-building exercise.

The Real Value of a Financial Model

Think of your financial model as your startup’s financial compass. It doesn’t just tell you where you are; it tells you where you’re heading and what financial obstacles might get in the way. This isn’t just a ‘nice to have’—it’s crucial for:

- Decision-making: When you’re trying to decide whether to hire more staff or expand into new markets, your financial model can project the financial impact of these decisions.

- Risk Management: A strong financial model will allow you to test various scenarios (what happens if sales dip by 20%?) and anticipate risks before they hit.

Now that we understand why this matters, let’s dig into how to actually build a financial model for your startup.

Building Your Startup’s Financial Model

1. Start with Realistic Revenue Projections

Revenue projections are the lifeblood of your financial model. You need to ask: How much money can I realistically expect to make? This requires both optimism and realism. Here’s how you should approach it:

- Top-Down and Bottom-Up Approaches: The TAM SAM SOM model is great for estimating revenue. TAM (Total Addressable Market) gives you the big picture, SAM (Serviceable Available Market) narrows it down to your target, and SOM (Serviceable Obtainable Market) tells you what slice of that pie you can realistically grab. But be careful—don’t just say “I’ll get 1% of a billion-dollar market.” Ask yourself: How will I get that 1%?

- Sales Cycle and Customer Acquisition: For startups, especially in the early stages, revenue doesn’t always grow in a straight line. Your financial model should account for how long it takes to acquire customers, the sales cycle length, and the churn rate.

For example, if you’re a SaaS startup, calculate your monthly recurring revenue (MRR), churn, and customer acquisition cost (CAC). Overestimate how long it will take to build traction—it’s better to be conservative than overly optimistic.

2. Don’t Skimp on Operating Expenses

Operating expenses (OPEX) are often underestimated by startups. These include marketing, salaries, rent, software tools, and anything else that keeps the lights on. You can’t afford to miss these costs because they directly impact your cash flow and how quickly you might burn through your available capital.

To make sure you’re capturing everything:

- Break down your operating expenses into categories: Sales and marketing, General and Administrative, and Research & Development.

- Include future hires: Plan for when and how much you’ll pay your team as you grow.

- Marketing and customer acquisition: Plan for marketing spend to rise as you scale. This isn’t an area you can afford to underestimate, especially if you’re relying on digital channels with rising costs (e.g., Google Ads or Facebook Ads).

3. Factor in Cost of Goods Sold (COGS)

If you sell a physical product, you’ll need to project Cost of Goods Sold (COGS). This refers to the direct costs involved in making your product, such as raw materials, manufacturing labor, and packaging. If you’re a service-based business, you might not have traditional COGS, but you’ll still have labor costs directly tied to delivering your services.

Your COGS play a critical role in determining your gross profit margin, which investors will scrutinize. A healthy margin suggests you can scale without hemorrhaging cash.

4. Capital Expenditures (CAPEX): Investing for the Future

Capital Expenditures (CAPEX) are the funds you spend on major long-term investments like equipment, office space, or intellectual property. This is different from OPEX because CAPEX involves upfront costs for assets that will benefit your business over several years.

Your financial model should clearly lay out your CAPEX investments and account for how they’ll impact both your cash flow and long-term growth. For instance, if you’re investing in new technology, your financial model should show how this will improve operational efficiency and reduce costs over time.

5. Creating a Cash Flow Forecast: Avoiding the Cash Crunch

The cash flow statement is probably the most crucial element of any financial model. It tracks the money flowing in and out of your business and ensures you don’t run out of cash—because even if you’re profitable on paper, a cash crunch can kill your business.

A good cash flow forecast breaks down:

- Operating activities (revenue and expenses)

- Investing activities (like CAPEX)

- Financing activities (raising capital, paying off loans)

Your financial model should provide a clear timeline of when you’ll hit positive cash flow or when you’ll need to raise more funding. Many startups fail not because they’re not profitable, but because they mismanage their cash flow.

6. Scenario Planning: Be Prepared for the Unexpected

When building your financial model, you should always be planning for multiple scenarios. Investors love seeing this because it shows you’ve thought through potential risks and rewards. Scenario planning typically includes:

- Best-case scenario: Everything goes right—fast customer acquisition, minimal churn, and strong revenue growth.

- Worst-case scenario: Sales take longer than expected, marketing costs skyrocket, or product delays push back launch dates.

- Base-case scenario: This is your most realistic projection, based on the current market, your resources, and achievable growth rates.

Running different scenarios in your financial model allows you to stay agile and respond quickly if things don’t go as planned. This is also where you can adjust your expenses or fundraising targets based on the trajectory of your business.

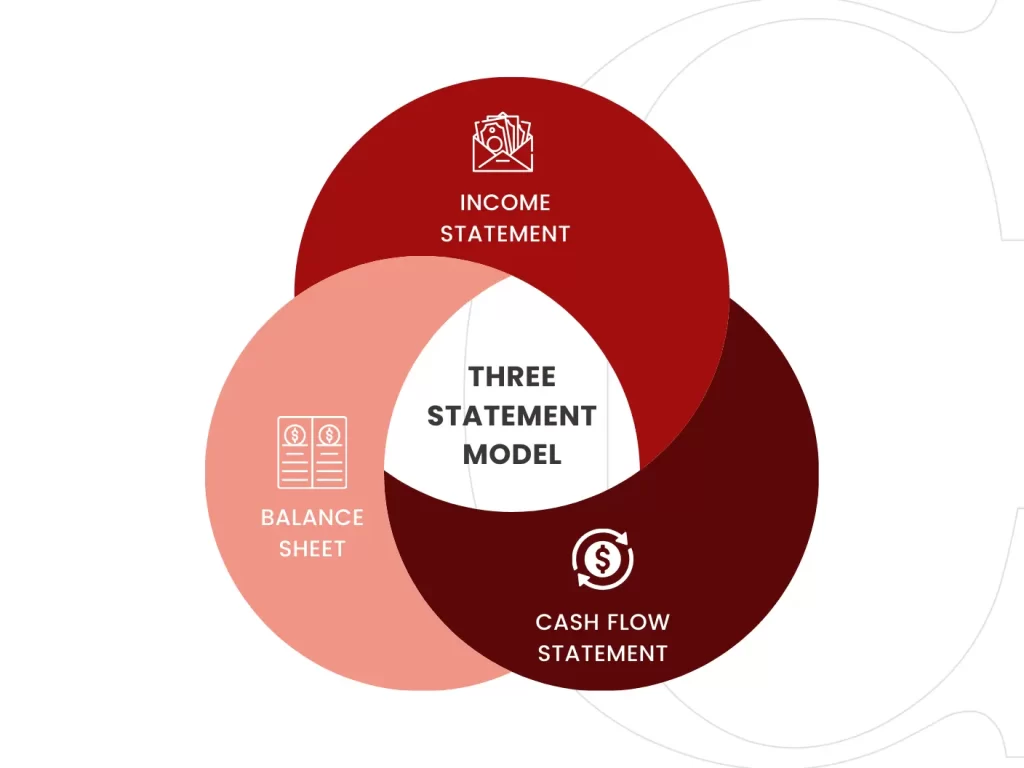

7. Use Financial Statements for a Complete View

A good startup financial model integrates three primary financial statements: the income statement, balance sheet, and cash flow statement. These financial statements give you a comprehensive view of your startup’s performance.

- Income Statement: Tracks your revenues and expenses over a specific period, allowing you to measure profitability.

- Balance Sheet: Shows your assets, liabilities, and equity, providing a snapshot of your business’s financial health.

- Cash Flow Statement: Tracks the movement of money into and out of your business and is crucial for managing liquidity.

These statements are the backbone of your financial model and are especially important when you’re pitching to investors or applying for loans.

Types of Financial Models Startups Can Use

1. Three-Statement Model

This is the basic model every startup should have. It includes the income statement, balance sheet, and cash flow statement. Together, these three give you a holistic view of your company’s financial health, allowing you to track profitability, liquidity, and debt levels over time.

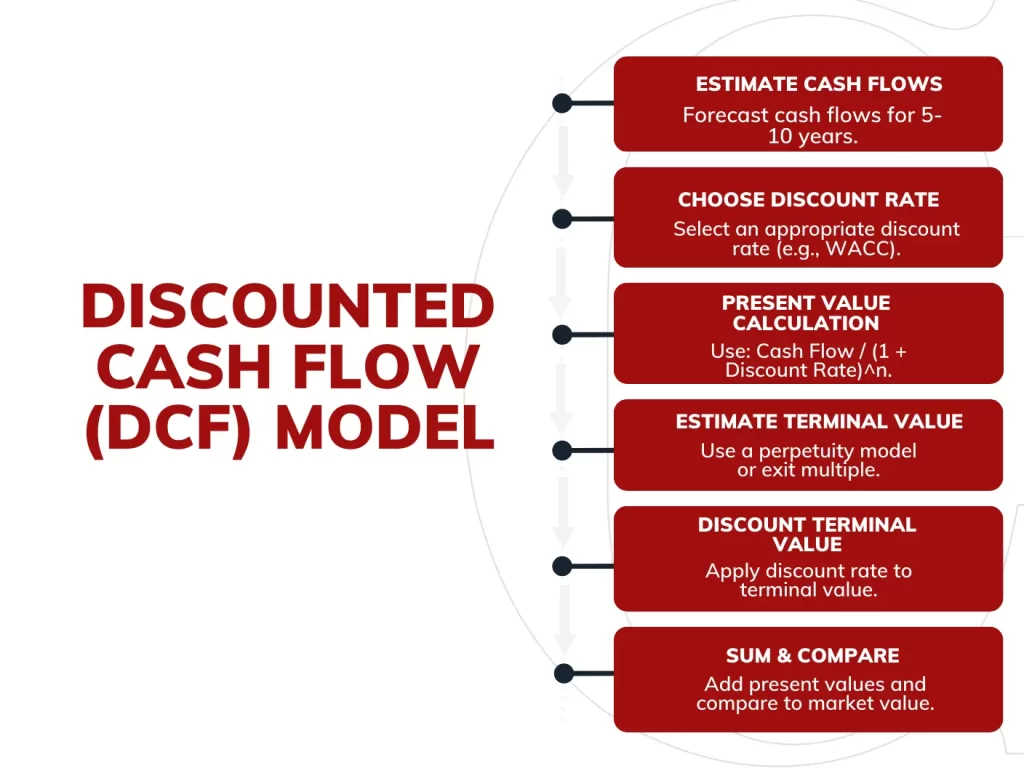

2. Discounted Cash Flow (DCF) Model

If you’re seeking equity funding, a Discounted Cash Flow (DCF) model is essential. This model estimates the present value of future cash flows and is a favorite among investors because it helps them assess the financial viability of a business. DCF requires accurate cash flow forecasting and risk analysis to be effective.

3. TAM SAM SOM Model

When you’re trying to understand your market potential, the TAM SAM SOM model is crucial. It breaks down the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM), helping you figure out what portion of the market you can realistically capture. This is vital when forecasting revenues.

Common Pitfalls to Avoid in Financial Modeling

Even with the best intentions, startups often make mistakes in their financial models. Here are some common errors and how to avoid them:

- Overestimating Revenue: Don’t let optimism get the best of you. Overestimating sales or assuming you’ll grab a large share of the market too quickly can lead to cash flow issues.

- Underestimating Operating Expenses: Many startups overlook key costs like software licenses, taxes, and legal fees. Make sure your financial model includes a buffer for unexpected expenses.

- Inconsistent Assumptions: Your assumptions about growth, costs, and customer acquisition need to be aligned. If your revenue projections show exponential growth, but your marketing budget stays flat, your model will fall apart.

Tools for Building a Financial Model

1. Excel and Google Sheets: The Backbone of Financial Modeling

Without a doubt, Microsoft Excel remains the go-to tool for financial modeling. Why? Because it’s incredibly versatile and allows you to build custom financial models tailored to your specific needs. If you’re comfortable with formulas, pivot tables, and advanced data analysis, Excel can handle everything from three-statement models (income statement, balance sheet, and cash flow statement) to detailed scenario planning.

Google Sheets adds an extra layer of collaboration, allowing teams to work together in real-time. For startups that need flexibility and customization but still want to maintain control over their modeling processes, Excel and Google Sheets are unparalleled.

However, as powerful as these tools are, they require a high degree of financial acumen. If you don’t know your way around Excel, the steep learning curve can be a problem. Also, maintaining and updating these models manually can become cumbersome as your startup scales.

2. LivePlan: The Simplicity Your Startup Needs

For startups that don’t need the complexity of custom models and just want a clean, efficient way to build financial projections, LivePlan is an excellent choice. It provides ready-made templates for creating financial forecasts, generating investor reports, and even creating business plans.

LivePlan is particularly useful for early-stage companies who need a professional financial model without diving too deeply into the technical aspects.

While LivePlan is a great tool for startups looking to simplify the process, it lacks the flexibility that more advanced tools offer. If your startup requires a highly customized model or more granular control over every detail, LivePlan may feel limiting.

3. BizPlan: Perfect for Fundraising

If your main goal is to raise capital—whether through venture capital, angel investors, or even crowdfunding—BizPlan is a fantastic tool. Much like LivePlan, BizPlan offers structured templates to create your financial model and business plan. However, BizPlan takes it a step further by integrating with Fundable, a platform specifically designed for startups seeking funding through equity crowdfunding.

Startups that use BizPlan can move through the fundraising process more efficiently because of the platform’s focus on producing investor-friendly content. It’s especially useful for companies that need to generate both financial projections and compelling business plans to share with potential investors.

Again, BizPlan has its limitations in terms of customization. While it’s great for getting a standard model up and running, you won’t have the flexibility to create complex models with custom assumptions or metrics beyond what the template offers.

4. Causal: Data-Driven and Scalable

For startups looking to scale and make data-driven decisions, Causal is an excellent tool. It’s not your typical financial modeling software—it’s built to handle dynamic scenario planning, real-time integrations, and more advanced forecasting techniques. This platform excels in helping businesses connect their financial models to live data sources, such as accounting platforms or CRM systems, making it an advanced choice for more sophisticated financial modeling needs.

In terms of drawbacks, Causal is more expensive and has a steeper learning curve than tools like LivePlan or BizPlan. It’s best suited for startups with larger budgets and those that require constant updates to their models.

5. Xero and QuickBooks: Financial Management with Modeling Capabilities

While Xero and QuickBooks are generally known as accounting tools, they have evolved to include basic financial modeling capabilities. They automatically generate real-time reports like cash flow statements, balance sheets, and income statements, which can be invaluable for early-stage startups managing day-to-day finances.

For startups that already use Xero or QuickBooks for accounting, the integration of financial modeling features is a bonus. These platforms are not as advanced as Causal or Excel, but they serve as a great entry-level solution for businesses that need both accounting and basic financial modeling in one place.

Why Financial Modeling is a Must-Have for Startups

Financial modeling isn’t just about numbers; it’s about understanding the financial engine of your business. A well-built startup financial model helps you navigate uncertainty, make informed decisions, and build trust with investors. More importantly, it helps you avoid the common financial pitfalls that derail many startups.

Key takeaways:

- Financial models help startups forecast cash flow, manage capital, and plan for future growth.

- By building a detailed financial model, you provide clarity for yourself and for investors on how your startup plans to grow.

- Use scenario planning to anticipate potential risks and stay agile in your decision-making.

- Always include realistic revenue projections, operating expenses, and a well-thought-out cash flow forecast.

Point being – financial modeling is the secret weapon that helps startups move from an idea to a profitable and scalable business. Take the time to build it right, and you’ll have a tool that grows with you.

At Capidel Consulting, we provide expert financial and strategic advisory services designed to drive growth and sustainability. Partner with us for tailored solutions that meet your business needs.