A great pitch deck isn’t just a set of slides—it’s your chance to showcase your business’s potential to investors. Whether you’re an early-stage startup or a company looking to scale, your deck needs to communicate vision, value, and viability. Investors want to see that you not only understand the market but also have a concrete path to profitability. The key is to craft a deck that blends storytelling with precise data, particularly your financial projections.

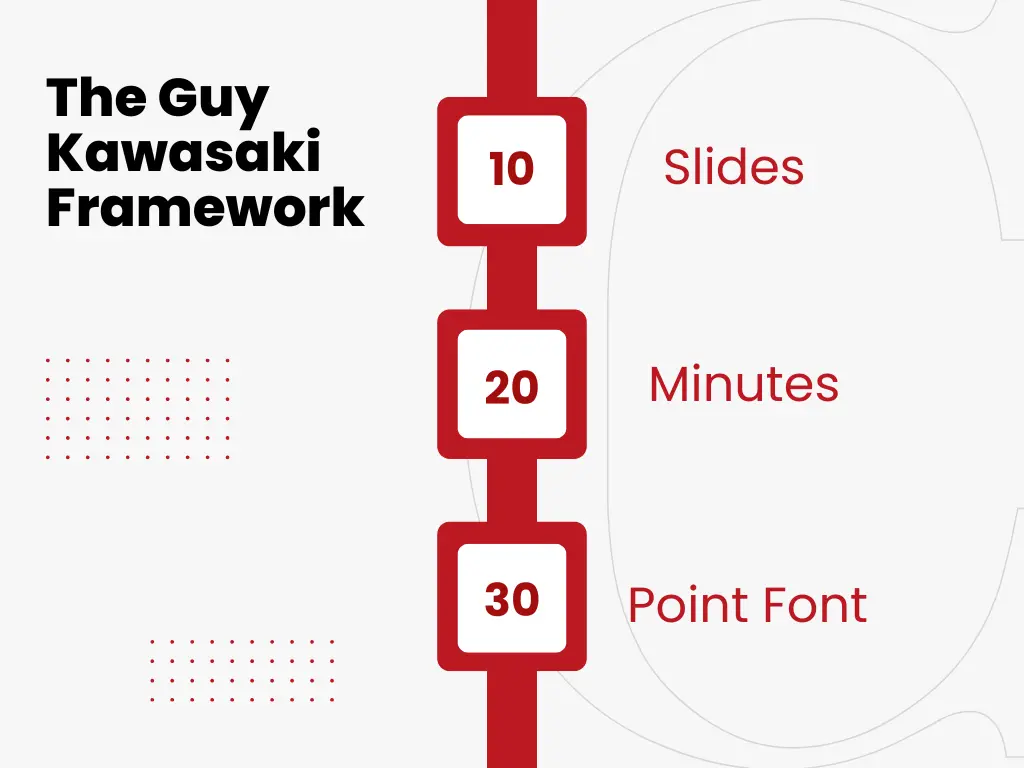

The Guy Kawasaki Frame Work

The Guy Kawasaki 10/20/30 Rule is a simple framework for creating effective and engaging presentations, especially for pitch decks. It is based on three key principles:

- 10 Slides: The ideal pitch deck should have no more than 10 slides. Guy Kawasaki argues that most investors cannot process more than 10 concepts in one meeting, and the goal is to keep the presentation concise and focused. The 10 slides typically cover the following key points:

- Problem

- Your solution

- Business model

- Market opportunity

- Go-to-market strategy

- Competitive landscape

- Product roadmap

- Financials

- Team

- Call to action

- 20 Minutes: Your presentation should last no longer than 20 minutes. Even if you have a one-hour meeting, unforeseen circumstances can shorten your time, so it’s important to be able to deliver your core message quickly and effectively. This also leaves time for questions and discussion.

- 30-Point Font: Use a minimum of 30-point font size for the text in your slides. This forces you to be concise and not overwhelm the audience with too much information. The larger font also ensures that the audience focuses on the most important points, and prevents the temptation to read directly from the slides.

By following this rule, your pitch deck remains clear, engaging, and easy to understand, making it more likely to capture the attention of investors.

Building the Structure of a Winning Pitch Deck

A successful pitch deck tells a coherent and compelling story. It’s not just about flashy visuals or numbers—it’s about tying everything together in a way that convinces investors of your company’s long-term potential. Here’s the core structure every pitch deck should follow:

- Problem: Clearly define the market pain point or gap your product addresses. Investors need to know why this problem is worth solving.

- Solution: Present your product as the answer to that problem. Highlight your unique value proposition (UVP) and show how it differentiates you from competitors.

- Market Opportunity: Detail the size and demand of the market. This section is where you prove the scalability of your business by providing hard data on market size, trends, and opportunities for growth.

- Business Model: Outline how your company generates revenue. Show that you’ve thought through customer acquisition, pricing, and potential for profit.

- Traction: Highlight your traction to date. Whether it’s early sales, partnerships, or user engagement, investors want evidence that your business is gaining momentum.

- Financial Projections: This is a critical section we’ll cover in detail shortly.

- Team: Investors back people, not just ideas. Showcase your leadership team’s expertise and why they’re the right people to execute this vision.

- Ask: Be clear about how much capital you need and what you plan to do with it. Investors want to know how their money will be used to drive growth.

Key Financial Statements to Include

The financial section of your pitch deck is where you can make or break investor confidence. Investors are looking for data that gives them insight into your company’s financial health and future potential. Here are the financial statements you must include:

Income Statement (Profit & Loss Statement)

Your income statement offers a summary of your company’s revenue, expenses, and net income. Investors will use this to gauge profitability. Key components include:

- Revenue: Detail your revenue streams—whether from product sales, services, or subscriptions. Provide both historical data and projected revenue growth for the next 3-5 years.

- Cost of Goods Sold (COGS): Show the direct costs involved in delivering your product. Investors want to see that you understand your cost structure.

- Gross Profit: This is a crucial metric. Investors look at gross margin to assess how efficiently you turn revenue into profit.

- Operating Expenses: Include overheads like salaries, marketing, and office costs. Investors will analyze how well your company scales with these expenses.

- Net Profit: The bottom line—how much of your revenue turns into profit. Compare this with industry benchmarks to show competitive performance.

Cash Flow Statement

Your cash flow statement demonstrates how money moves in and out of your business, showing how well you manage liquidity. Investors place high importance on this, especially for startups with limited resources.

- Operating Activities: Cash generated or used by your day-to-day operations.

- Investing Activities: Any capital investments, such as equipment purchases or software development.

- Financing Activities: This includes fundraising, loan repayments, or any actions related to obtaining capital.

A positive cash flow signals to investors that your business can handle growth and unforeseen expenses without running out of money.

Balance Sheet

The balance sheet is a snapshot of your company’s financial health at a given point. It outlines your assets, liabilities, and equity—giving investors a clear picture of your company’s stability.

- Assets: These are resources owned by the company, such as cash, equipment, or intellectual property.

- Liabilities: Any obligations, like loans or payables.

- Equity: What’s left after liabilities are deducted from assets—essentially the net worth of your company.

Investors will focus on whether you have the assets to sustain growth and meet your obligations.

Financial Projections

While the income statement, cash flow statement, and balance sheet provide insight into your current situation, your financial projections offer a forward-looking view. Projections typically cover 3-5 years and help investors assess future potential.

- Revenue Forecasts: Provide a detailed projection of sales growth, factoring in market conditions and expansion plans.

- Profit Margins: Show projected improvements in profit margins as your business scales.

- Customer Acquisition Cost (CAC) and Lifetime Value (LTV): These metrics reveal how efficiently you can acquire customers and their expected value over time. A low CAC with a high LTV is a strong indicator of profitability.

- Burn Rate: This is especially critical for startups—burn rate shows how fast you’re spending cash and how long your current funds will last.

Expert Tips for a Standout Pitch Deck

The financials form the backbone of your pitch deck, but for a successful pitch, you need to wrap those numbers in a compelling narrative. Here are some expert tips for taking your pitch deck to the next level:

1. Tell a Story with Your Numbers

Your financial projections should tell a story about growth and opportunity. Don’t just present numbers—explain what drives them. For instance, show how your product roadmap ties into revenue growth, or how early market traction indicates long-term success. Numbers alone aren’t enough; they need to be contextualized.

2. Use Visuals to Make Complex Data Simple

Visuals can help break down complicated data. Use graphs and charts to highlight key metrics like revenue growth, gross margin, and burn rate. A well-designed visual will instantly communicate your business’s financial health. Avoid overcrowded slides—less is more when it comes to design.

3. Show Traction

Nothing speaks louder than results. Investors are far more interested in a business with proven traction than just an idea. Include metrics like early sales, customer feedback, or key partnerships. Traction validates your business model and demonstrates that your company is already making progress.

4. Highlight What Makes You Unique

Every investor has seen hundreds of pitch decks. To stand out, you need to showcase what sets you apart. Highlight your unique value proposition and how it ties back to your financials. How does your product or service position you better than competitors? Use concrete data to show why your company is poised for success.

5. Be Ready to Discuss Scalability

Investors care about whether your business can scale without running into operational bottlenecks. Be prepared to explain how you’ll manage growth without drastically increasing costs. Your financial projections should clearly show how scaling your operations will drive profitability, with a focus on metrics like CAC, LTV, and gross margins.

Avoid Common Pitfalls

Even the strongest pitch deck can falter due to a few common mistakes. Here’s what to watch out for:

- Too Much Data: Resist the urge to overload your deck with endless numbers. Focus on the metrics that matter most to investors—less is often more.

- Unrealistic Projections: If your growth numbers are too optimistic, investors will question the feasibility of your plan. Ground your projections in reality.

- Poor Design: A cluttered or amateur-looking deck can distract from your message. Invest in professional design to keep the focus on your content.

Sealing the Deal with a Standout Pitch

A great pitch deck goes beyond presenting slides—it’s about conveying your vision, backed by solid data, and demonstrating how you’ll deliver on that vision. By focusing on key financial statements, telling a compelling story, and highlighting your traction, you can create a pitch deck that resonates with investors and increases your chances of securing the funding you need. Keep your deck concise, visually engaging, and tailored to your audience—this is your chance to seal the deal.

Pitch to win with Capidel – Let’s craft a deck that gets you funded.

Reach us out now!